What No One Tells You About Passing Down Wealth — Tax-Smart Moves That Actually Work

Inheriting assets isn’t just about receiving money or property — it’s a financial crossroads filled with hidden tax traps. I’ve seen families lose thousands simply because they didn’t plan ahead. When my uncle passed, we learned the hard way how taxes can quietly eat away at legacy wealth. That moment changed how I view inheritance. It’s not just about what you leave behind — it’s about how smart you play it before you do. Many people assume that writing a will is enough to protect their family’s financial future, but the truth is far more complex. Without thoughtful planning, even substantial estates can shrink dramatically due to overlooked tax obligations. The journey of wealth transfer is not just legal or emotional — it’s deeply financial, and every decision carries long-term consequences. Understanding the mechanics behind tax-efficient inheritance can mean the difference between preserving a legacy and watching it erode.

The Hidden Cost of Inheritance: When Taxes Take More Than Expected

When someone inherits money, property, or investments, the immediate reaction is often one of gratitude and relief. However, what follows can be a surprise — a tax bill that significantly reduces the value of what was passed down. This is not due to malice or deception, but rather to a system of overlapping tax rules that many families simply do not anticipate. The primary culprits are estate taxes, inheritance taxes, and capital gains taxes, all of which can apply depending on location, asset type, and the relationship between the giver and receiver. While federal estate taxes in the United States only affect very large estates, many states impose their own estate or inheritance taxes with lower thresholds, meaning even middle-income families can be impacted.

One of the most common pitfalls occurs with real estate. A family home may have been purchased decades ago for a fraction of its current market value. When passed to heirs, the appreciation in value can trigger substantial capital gains taxes if the property is later sold — unless the step-up in basis rule applies, which will be discussed in detail later. Similarly, investment accounts such as brokerage portfolios may carry unrealized gains that become taxable upon sale by the beneficiary. Retirement accounts like traditional IRAs and 401(k)s present another challenge: while they represent saved wealth, they are also tax-deferred, meaning the government has not yet collected income tax on those funds. When heirs begin taking required minimum distributions, they must pay income tax on the withdrawals, sometimes pushing them into higher tax brackets.

The presence of a will does not eliminate these tax consequences. A will guides how assets are distributed, but it does not override tax law. In fact, probate — the legal process of validating a will — can delay access to funds, create public records, and increase administrative costs, all of which indirectly affect the net amount heirs receive. Without proactive planning, families may find themselves making rushed financial decisions under pressure, such as selling a home quickly to cover tax bills, which can lead to unfavorable terms. The key takeaway is that inheritance is not a one-time event but a process — and without awareness of the tax landscape, even well-intentioned plans can fall short of their intended impact.

Why Asset Allocation Matters More Than You Think in Estate Planning

Most people associate asset allocation with investment growth — balancing stocks, bonds, and cash to meet financial goals while managing risk. But asset allocation plays an equally critical role in estate planning, particularly when it comes to minimizing tax exposure for heirs. Not all assets are created equal from a tax perspective, and how they are structured and held can have lasting implications for the next generation. For example, retirement accounts such as traditional IRAs and 401(k)s are highly tax-inefficient when passed on because they generate taxable income for beneficiaries. On the other hand, assets held in Roth IRAs, after-tax brokerage accounts, or certain types of life insurance policies can offer more favorable tax treatment upon transfer.

Strategic allocation involves considering not just returns, but also tax characteristics and liquidity. A portfolio heavy in tax-deferred retirement accounts may look impressive on paper, but it could create a significant tax burden for heirs who must take distributions over time. By contrast, shifting some savings into Roth accounts — where qualified withdrawals are tax-free — can provide heirs with access to funds without triggering additional income tax. Similarly, placing high-growth assets in tax-advantaged accounts and holding lower-turnover investments in taxable accounts can enhance after-tax outcomes. This approach, known as asset location, goes beyond simple diversification and aligns investments with their most tax-efficient environments.

Another important consideration is the mix of liquid and illiquid assets. Heirs may face immediate tax obligations or estate settlement costs that require cash. If the estate consists mostly of real estate, private business interests, or collectibles, selling these assets quickly to raise funds could mean accepting below-market prices. Including a portion of liquid, low-volatility investments such as money market funds or short-term bonds can provide flexibility during transition periods. Moreover, business owners should evaluate whether their company’s structure allows for smooth succession, both operationally and tax-wise. Transferring ownership gradually, using tools like family limited partnerships, can reduce valuation for tax purposes while maintaining control during life.

The goal is not to maximize wealth on a balance sheet, but to preserve its usable value for those who will inherit it. Thoughtful asset allocation today can prevent difficult choices tomorrow. By reviewing portfolios with an eye toward both growth and tax efficiency, individuals can ensure that their heirs receive more than just numbers on a statement — they receive financial stability and freedom from avoidable tax burdens.

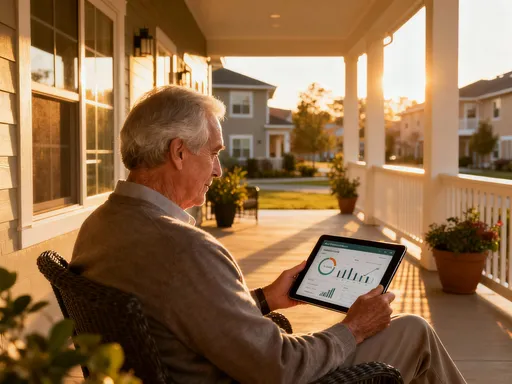

Gifting While Living: A Quiet but Powerful Tax Strategy

One of the most effective yet underutilized strategies for reducing future tax liability is lifetime gifting. Instead of waiting until death to transfer wealth, individuals can begin sharing assets during their lifetime in a way that lowers the size of their taxable estate and provides immediate benefit to loved ones. This approach allows givers to witness the positive impact of their generosity while retaining control over the process. From a tax standpoint, annual gifts that fall within the gift tax exclusion limit do not count toward the lifetime exemption and are not subject to gift tax. While the specific dollar amount changes over time due to inflation adjustments, the principle remains: small, consistent transfers can add up significantly over the years without triggering tax consequences.

Consider a grandparent who gives $15,000 each year to each of their four grandchildren. Over ten years, that amounts to $600,000 transferred tax-free — money that can be used for education, homeownership, or starting a business. These gifts not only reduce the size of the estate but also allow the recipients to benefit from compound growth on the gifted funds. If the money is invested wisely, it can grow substantially before the giver passes away, effectively multiplying the value of the original transfer. Additionally, removing appreciating assets from the estate before they increase further in value can prevent those gains from being taxed twice — once as part of the estate and again as capital gains.

Beyond the financial advantages, lifetime gifting fosters stronger family relationships. It opens conversations about money, values, and responsibility. Parents or grandparents can attach guidance to their gifts, helping younger generations learn how to manage wealth thoughtfully. For example, funding a child’s down payment on a home comes with an opportunity to discuss budgeting, mortgage responsibilities, and long-term financial planning. These moments build financial literacy and reinforce the idea that wealth is not just for consumption, but for stewardship.

It’s important to note that certain types of gifts require careful handling. Transferring ownership of real estate or business interests may trigger gift tax reporting requirements if the value exceeds the annual exclusion. Additionally, giving away assets too early could affect the giver’s own financial security, especially if unexpected medical or living expenses arise. That’s why coordination with a financial advisor is essential — to ensure that gifting aligns with overall retirement and healthcare planning. When done responsibly, lifetime gifting is not a loss of control, but a strategic redirection of resources that benefits both giver and receiver.

Trusts: Not Just for the Super Rich, and Not as Complicated as You Think

Trusts are often misunderstood as tools reserved for the ultra-wealthy, but in reality, they offer practical benefits for a wide range of families. At its core, a trust is a legal arrangement in which one party — the grantor — transfers assets to a trustee, who manages them for the benefit of designated beneficiaries. There are two main types: revocable and irrevocable. A revocable trust allows the grantor to retain control, make changes, and even dissolve the trust during their lifetime. Because the grantor maintains ownership, the assets remain part of their taxable estate, but the trust still provides advantages such as avoiding probate and maintaining privacy. An irrevocable trust, on the other hand, removes assets from the grantor’s estate permanently, which can reduce estate tax exposure, though it comes with less flexibility.

One of the greatest benefits of a trust is its ability to bypass probate — the court-supervised process of distributing assets according to a will. Probate can take months or even years, involves public filings, and incurs legal fees. A properly funded trust allows assets to be transferred directly to beneficiaries without court involvement, ensuring faster access to funds during a difficult time. This is particularly valuable when minor children or dependent adults are involved, as it enables timely support without delays. Trusts also allow for structured distributions, meaning beneficiaries don’t receive large sums all at once. For example, a parent might specify that a child receives one-third of the inheritance at age 25, another third at 30, and the remainder at 35. This prevents impulsive spending and supports long-term financial maturity.

Another advantage is control over asset use. A trust can include provisions that tie distributions to specific milestones, such as completing college, getting married, or maintaining employment. It can also protect assets from creditors or divorce proceedings, depending on the type of trust and jurisdiction. Special needs trusts are designed to provide for beneficiaries with disabilities without jeopardizing their eligibility for government assistance programs like Medicaid or Supplemental Security Income.

Setting up a trust does not have to be complicated or expensive. Many financial institutions and estate planning attorneys offer standardized trust packages tailored to common family situations. The key is to fund the trust properly — that is, to retitle assets such as bank accounts, real estate, and investment holdings into the name of the trust. Without this step, the trust remains empty and ineffective. While trusts are powerful tools, they are not one-size-fits-all. Families should consult with qualified professionals to determine whether a trust makes sense for their situation, what type to use, and how to integrate it with other estate planning documents like wills and powers of attorney.

Step-Up in Basis: The Golden Rule Everyone Should Know

Among the most powerful tax benefits in estate planning is the step-up in basis, a rule that can dramatically reduce or even eliminate capital gains tax for heirs. To understand this concept, consider how capital gains are calculated: when an asset is sold, the taxable gain is the difference between the sale price and the original purchase price, known as the cost basis. If someone bought stock for $10,000 and it’s worth $100,000 at the time of sale, the taxable gain is $90,000. However, if that person passes away and the asset is inherited, the cost basis is typically “stepped up” to the market value at the date of death. In this example, the heir’s cost basis becomes $100,000. If they sell it immediately for $100,000, there is no capital gain — and therefore no tax.

This rule applies to a wide range of assets, including stocks, bonds, real estate, and mutual funds. It is especially beneficial for property that has appreciated significantly over time, such as a family home purchased decades ago. Without the step-up, heirs could face a massive tax bill upon sale. With it, they can liquidate the asset tax-efficiently, preserving more of the value for their own use. The step-up in basis is automatic in most cases and does not require special filing, but it only applies at death — not during lifetime gifts. That’s why timing and ownership structure are so important.

A common mistake is adding adult children to a property deed while the parent is still alive. While this may seem like a simple way to avoid probate, it can backfire. If the child is listed as a joint owner, they inherit the parent’s original cost basis for their share, not the stepped-up value. When the property is sold, the capital gains tax applies to the appreciation from the original purchase date, potentially leading to a large tax liability. A better approach is to keep the property in the parent’s name and use a transfer-on-death deed or place it in a trust, allowing the full step-up to apply upon death.

It’s also important to note that the step-up applies only to assets included in the taxable estate. Assets that pass outside of the estate, such as those with designated beneficiaries, may still qualify, but coordination is essential. Understanding this rule empowers families to make informed decisions about when and how to transfer assets, ensuring that appreciation built over a lifetime does not become a tax burden for the next generation.

Coordinating Beneficiaries and Accounts: The Devil’s in the Details

Even the most carefully crafted estate plan can be undermined by outdated or inconsistent beneficiary designations. Unlike wills, which provide general instructions for asset distribution, certain financial accounts pass directly to named beneficiaries regardless of what the will says. This includes retirement accounts, life insurance policies, annuities, and payable-on-death (POD) bank accounts. These instruments bypass probate and transfer automatically upon death, which is efficient — but only if the information is accurate and aligned with the overall estate strategy.

Problems arise when beneficiary forms are not updated after major life events such as marriage, divorce, the birth of children, or the death of a loved one. For example, a woman who divorced years ago may still have her ex-spouse listed as the primary beneficiary on her 401(k). Unless she updated the form, the account will go to him, even if her will leaves everything to her children. Similarly, failing to name contingent beneficiaries can create complications. If the primary beneficiary predeceases the account holder and no backup is named, the asset may revert to the estate, triggering probate and potential tax inefficiencies.

Another issue is the mismatch between the size of an account and the needs of the beneficiary. A large IRA left to a young adult who is unprepared to manage it could lead to poor financial decisions or unnecessary tax consequences if withdrawals are taken too quickly. Staggering distributions through a trust or using the stretch IRA strategy — where required minimum distributions are based on the beneficiary’s life expectancy — can help preserve the account’s value over time.

To avoid these pitfalls, individuals should conduct a regular audit of all accounts with beneficiary designations. This includes gathering statements, reviewing forms, and confirming that the information reflects current wishes. It’s also wise to discuss these choices with family members to prevent surprises. Financial institutions typically provide simple forms for updates, and many allow online changes. The process takes little time but can have a profound impact on how smoothly wealth is transferred. Attention to detail here ensures that intentions are honored and that heirs receive what was meant for them — without legal disputes or avoidable taxes.

Talking to Heirs: The Emotional Side of Tax-Smart Inheritance

Financial strategies are essential, but they are only part of the equation. The emotional dimension of inheritance is equally important, and open communication can prevent misunderstandings, resentment, and poor decision-making. Many families avoid discussing money out of discomfort, fear of conflict, or the belief that it should be a surprise. But silence often leads to confusion. Heirs may not understand why certain decisions were made — such as unequal distributions due to prior lifetime gifts or the use of trusts instead of direct transfers. Without context, these choices can be misinterpreted as favoritism or unfairness.

Conversations about inheritance don’t have to be formal or somber. They can take place during family gatherings, vacations, or one-on-one discussions. The goal is not to disclose exact dollar amounts, but to share values, intentions, and expectations. Explaining why a trust was created, how assets are structured, or why gifting began early helps heirs appreciate the thought behind the plan. It also prepares them to manage wealth responsibly. Research shows that heirs who are educated about family finances are more likely to preserve and grow what they inherit, rather than deplete it within a few years.

Parents and grandparents can use these discussions to pass on more than money — they can pass on wisdom. Sharing stories about financial challenges, lessons learned, and long-term goals creates a narrative that connects past, present, and future. It reinforces the idea that wealth is a tool for security, opportunity, and contribution, not just personal comfort. Including younger generations in financial education — such as budgeting, investing basics, or charitable giving — equips them with skills that will serve them throughout life.

These conversations also provide an opportunity to address non-financial legacies. Letters of intent, ethical wills, or recorded messages can convey personal values, hopes, and blessings. While not legally binding, they offer emotional clarity and closure. When heirs feel understood and included, they are more likely to honor the giver’s vision and work together as a family. Inheritance, when handled with care and communication, becomes not just a transfer of assets, but a continuation of love and legacy.

Passing down assets is more than a financial transaction — it’s a final act of care. With smart tax planning, you’re not just reducing liabilities; you’re preserving value, clarity, and peace of mind for those you leave behind. The best inheritance isn’t just what you give — it’s how well you prepare them to receive it.